Attention Homeowners & Contractors

BIG, BEAUTIFUL BILL PASSES

Don't Rush into a Solar Mistake

The Big, Beautiful Bill Passed

This means the 30% Federal Solar Tax Credit is getting cut in 2025. Take advantage of this benefit before it’s gone with new solar systems or select add-ons. Quality Home Services recommends starting your solar project by September 30th to help ensure compliance and completion before the December cut-off.

Homeowners & Contractors, Don’t Rush into a Solar Mistake

Homeowners and contractors are facing more than just a shrinking incentive. They’re entering a new era of compliance, complexity, and costly missteps if they’re not paying attention.

What Can Get Overlooked

Under Title 24, Section 6, California mandates that most home additions, ADUs, and major remodels meet solar energy requirements. While this is a smart step toward cleaner energy, it can come with unintended consequences.

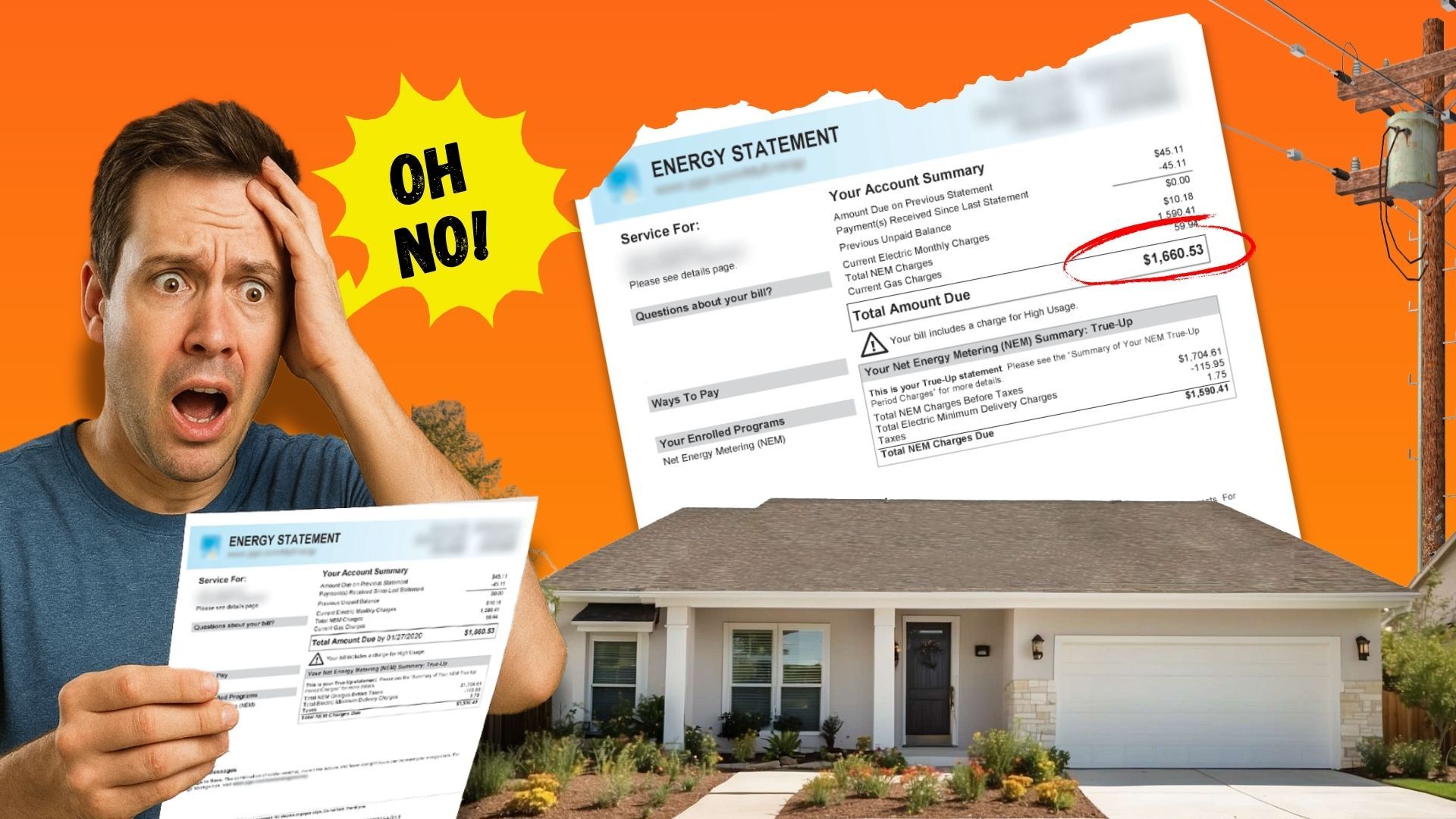

One customer who already had solar reached out to Quality Home Services in July after they found out their new gazebo project required additional solar panels. They were surprised to learn that if not done correctly, their add-ons could trigger a change in their utility bill. This would force them out of their current NEM plan and lose their previous benefits.

The Catch?

Most homeowners and contractors don’t even know this risk exists. At Quality Home Services, we've been navigating this issue from the start. We’ve helped countless homeowners retain their NEM 2.0 benefits while remaining compliant with state solar mandates, protecting both their long-term energy savings and their renovation plans.

If you’re a homebuilder, general contractor, or ADU specialist, now is the time to partner with an experienced solar expert who understands the regulations and policy shifts. Give your clients the upgrades they want without sacrificing the solar benefits they’ve earned.

Contact Steve Saeger to learn more about partnering with a trusted solar expert at steve@solarbyqhs.com.