Few Spots Left to Qualify for the 30% Solar Tax Credit.

We’ve opened a limited number of installation spots to help homeowners lock in the 30% federal solar tax credit before October 21st!

Last Chance to Qualify.

Secure Your Installation and 30% Tax Credit Today.

Solar projects take time to complete — from permitting to utility approvals and installation scheduling, every step adds up. That’s why waiting too long can push your project past the deadline for this year’s 30% federal solar tax credit.

To help homeowners lock in their savings, we’ve opened a few remaining installation spots for qualified applicants. These are designed to ensure your system can be completed and approved in time to qualify.

Once these final spots are filled, we can’t guarantee eligibility for the 30% credit — so now’s the time to start your solar project and secure your savings while there’s still availability.

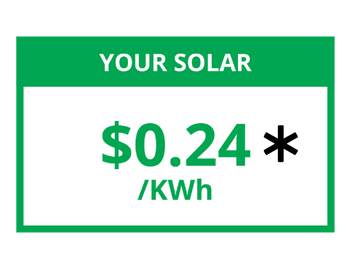

Choose your own power source, powered locally by Quality Home Services.

*Qualified customers can save up to half on their electricity bills.

Spots Are Filling Fast — Don’t Miss Your Chance to Lock In the 30% Tax Credit

We Make Going Solar Simple—No Matter Your Budget

Whether you want to own your system, avoid a large upfront cost, or just want the lowest possible energy bill, we have flexible options designed for your goals:

💬 Frequently Asked Questions About Solar Costs & Incentives

How much does going solar actually cost?

The cost of a solar system depends on your home’s size, energy usage, and the type of financing you choose. That said, most homeowners are surprised at how affordable it can be—especially when factoring in long-term energy savings and available incentives. We offer several flexible options so that solar works for you, not the other way around.

Do I have to pay everything upfront?

Not at all. While you can purchase your system outright, many homeowners prefer to finance or lease it. There are options with no upfront cost, low monthly payments, or payment structures based only on the energy you use. You’re in control of how you want to pay for solar—we’re here to guide you through what’s best for your situation.

How does the 30% federal tax credit work?

If you purchase your system (either with cash or a solar loan), you may qualify for the Federal Solar Investment Tax Credit (ITC)—which allows you to claim 30% of your total system cost as a credit on your federal taxes.

It’s not a refund check, but it can significantly lower what you owe in taxes for the year. This credit is set to decrease soon, so acting now helps you get the most value.